On Friday, European indexes experienced a significant decline due to a sharp drop in banking stocks, fueled by concerns over the financial sector’s stability. Deutsche Bank was particularly affected, as the cost of insuring its debt against the risk of default surged to a level not seen in over four years.

Despite a 1.4% decline, the pan-European STOXX 600 index (.STOXX) managed to register a weekly increase, thanks to a strong rebound earlier in the week.

“Post what happened to Credit Suisse last weekend, investors don’t want to hold on to positions that have any concern around them over the weekend, getting out of such positions is probably what we’re seeing with Deutsche Bank,”

“And, of course, there is money to be made if you’re on the right side of an over-reaction in the stocks.”

said Paul van der Westhuizen

Following a significant increase in the cost of default insurance, Deutsche Bank (DBKGn.DE) experienced an 8.5% drop. The German bank also announced its intention to redeem $1.5 billion of Tier 2 notes scheduled to mature in 2028.

“Deutsche Bank has taken the place of Credit Suisse really as being the next sort of weakest link in the chain, possibly unjustly,”

David Goebel Associate Director of Investment Strategy at Evelyn Partners, said

UBS Group AG (UBSG.S) and Credit Suisse AG (CSGN.S) saw their shares decline by 3.6% and 5.2%, respectively, following a report from Bloomberg News. The report stated that the two banks were being investigated by the U.S. Department of Justice (DOJ) over suspicions that their financial professionals aided Russian oligarchs in evading sanctions.

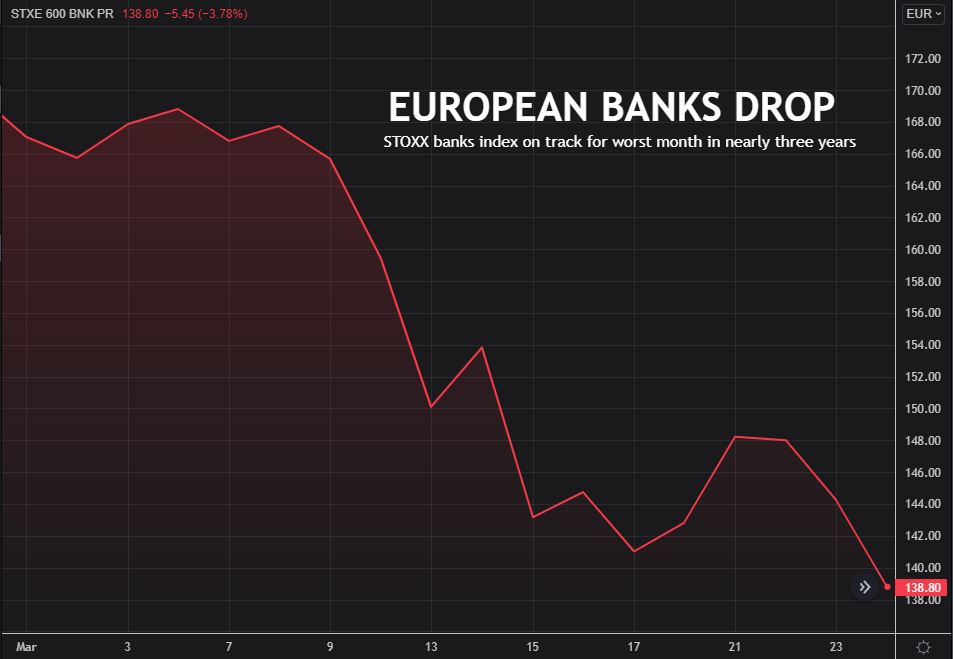

With the increasing risks to banks due to tightening financial conditions, European banks (.SX7P) experienced a 3.8% drop, resulting in their third consecutive week of declines. This was further compounded by the recent troubles at Credit Suisse and the failure of mid-sized U.S. lenders.

After a report from Reuters indicated that the European Central Bank was urging Raiffeisen Bank International (RBIV.VI) to wind down its lucrative operations in Russia, the bank’s shares fell by 7.9%.

In an effort to soothe concerns in the markets, European Union leaders and the ECB projected a united front regarding the banking sector, highlighting that EU banks had learned valuable lessons from the collapse of Lehman Brothers in 2008 and were presently well-capitalized and liquid. Despite this reassurance, fears of financial conditions tightening were further compounded by a series of interest rate hikes by central banks in Europe, including the Federal Reserve, which, despite signaling a pause in its hiking cycle, added to market jitters.

While the U.S. benchmark S&P 500 has gained 2.9% year-to-date, the STOXX 600, which had surged by 10% at one point, is up by only 3.5% for the same period.

According to a survey conducted by S&P Global, business activity in the eurozone picked up speed unexpectedly this month due to consumer spending on services. However, while the service sector saw an uptick, demand for manufactured goods decreased further, exacerbating the factory sector’s decline.